What is the difference between a credit freeze and a credit lock?

A Credit Freeze Is A Free Service That Stops New Accounts From Being Opened, While A Credit Lock Is A Service From The Credit Bureaus That Lets You Lock And Unlock Your Credit Faster Than A Freeze.

Ah, the eternal debate: credit freeze versus credit lock – it's like choosing between locking your front door or installing a state-of-the-art security system complete with laser beams and guard dogs. Picture this: you're safeguarding your financial fortress against the nefarious schemes of identity thieves when suddenly, you're faced with the perplexing decision of whether to freeze or lock your credit. Fear not, for I shall unravel the mystery for you like a financial Sherlock Holmes.

Unlocking the Mystery: Credit Freeze vs. Credit Lock

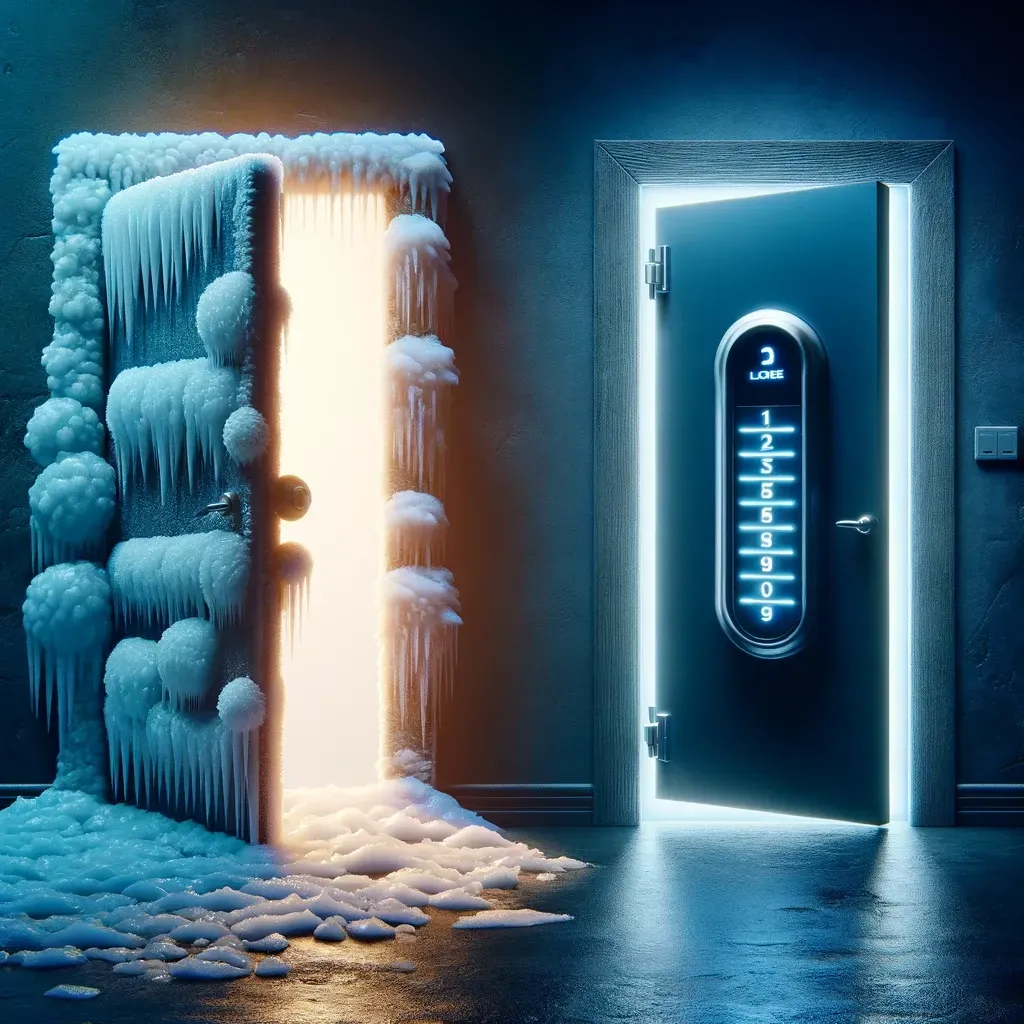

So, what's the deal with a credit freeze, you ask? Well, it's like putting your credit information on ice, freezing it solid so that no one – not even your nosy neighbor who always borrows your lawnmower without asking – can access your credit report without your explicit permission. It's the Fort Knox of credit protection, leaving would-be identity thieves shivering in their boots.

Now, let's talk about the credit lock – the sleek, modern cousin of the credit freeze. It's like upgrading from a medieval castle to a high-tech smart home with fingerprint scanners and retina recognition. With a credit lock, you have the power to control access to your credit report with just a few taps on your smartphone. It's convenient, it's flexible, and it's the epitome of 21st-century security measures.

But here's the kicker: while both options offer protection against identity theft, they come with their own set of pros and cons. A credit freeze provides robust security but may involve a bit more hassle when you need to apply for new credit, requiring you to thaw it temporarily. On the other hand, a credit lock offers convenience but may come with additional fees and terms that vary depending on the provider.

So, which option reigns supreme in the battle of credit protection? Well, that depends on your preferences and needs. Whether you choose to freeze or lock your credit, rest assured that you're taking a proactive step toward safeguarding your financial future against the forces of financial fraud.

In the world of credit repair, the option of pay-after-deletion presents a compelling opportunity for individuals looking to improve their credit health. With pay-after-deletion credit repair services, individuals have the flexibility to address inaccuracies on their credit reports without the burden of upfront financial commitment. By only paying for tangible results, individuals can ensure that their investment directly correlates with the outcomes they desire. Embracing pay-after-deletion credit repair empowers individuals to take control of their financial futures and pave the way for a brighter credit outlook.

GET A FREE QUOTE TODAY

Contact Us

Address:

407 Jackson Park Rd

Kannapolis, NC 28083

(By Appointment Only)

Phone

Tel: 813-345-4097

Text: 813-345-4097

Business Hours-

Monday - 8am - 7pm

Tuesday- 8am - 7pm

Wednesday - 8am - 5pm

Thursday - 8am - 7pm

Friday - 8am - 7pm

Saturday - 8am - 7pm

Sunday - closed